Thanks to the Internet, there are many ways to make cash online. Whether you want to make a living working on the Internet or simply earn some cash on the side, here are a few of the best ways to make money online.

Thanks to the Internet, there are many ways to make cash online. Whether you want to make a living working on the Internet or simply earn some cash on the side, here are a few of the best ways to make money online.

Did you know that the cost of a car can fluctuate based on the month or the day of the week? Now that you have decided it is time to buy a car, make sure you purchase it at the right time so you can get the best deal possible.

One reason to own your own airplane is the opportunity to add some fun to your everyday life. Although it can be a lot of fun to fly just for the sake of flying, there's something even better about having a destination in mind when you fuel up take to the sky. Aircraft ownership gives you an opportunity to take advantage of that independence.

I took a trip to the department store with my family one Saturday afternoon. I had just turned 16 and I noticed a huge banner that said, “JOB FAIR” on a well-known store’s entrance. I broke away from my family to go check it out. A woman ushered me into a small office, handed me a clipboard and told me once completed, to hand it to the HR representative behind a glass counter. I had no idea what I was doing but I figured I should go ahead and do as I was told.

Living in the technology age has created significant cultural shifts in terms of work and recreation for Millennials and other groups. The ability to enjoy real-time communication or work remotely offers today’s professional tremendous location flexibility. Work from home has morphed into work from anywhere you can get a Wi-Fi signal.

It's obvious that big banks spend heavily on marketing and advertising to attract new customers. But many of us remember the financial crisis and how massive corporate institutions mishandled hard-working Americans' money. That's why everyday people often consider an alternative to these corporate giants.

Nowadays people take it for granted that you can just hop in an airplane and get to the other side of the Earth in less than a day. However, this wasn't always the case. Modern aviation has been around for about a hundred years, although ancient peoples have been dreaming about flight from the dawn of time.

Tax time is here! As you prepare your returns this year it is important to remember that it’s peak season for tax fraud schemes. Tax fraud happens when someone uses your Social Security Number (SSN) to apply for your refund or to intimidate you into paying money that you do not owe. Criminals can also use your SSN to get around employment verification requirements or avoid being found out if they are on a list such as a sex offender registry.

Virtually no one would frown upon the idea of making more money doing what they love. There's nothing wrong with striving to increase the size of your paycheck. In fact, the Society for Human Resource Management conducted a survey and found that 63 percent of respondents said that compensation was a major contributing factor to job satisfaction. Here are a few tips that will help you score the higher paying job of your dreams.

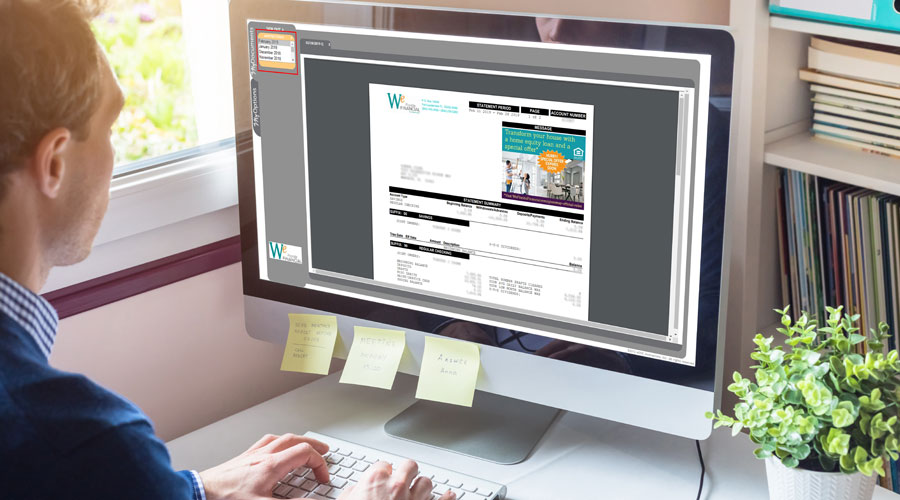

In this day and age, doing good for the environment should be a priority on everyone's mind. From cleaning up trash to reducing waste, people from all over the world are doing what they can to improve this planet. One way that’s done involves using e-statements over traditional paper statements. Although it seems like a minimal change, using e-statements can lead to some amazing benefits. While environmental change is a leading benefit, using e-statements poses some other incredible advantages. See below for a list of the benefits.

Since the earliest days of aviation, countless people have dreamed of owning and piloting an aircraft of their own. It used to be a hobby for the fortunate few, but aircraft ownership is now surprisingly affordable, and there are also far more flying schools around than ever before.

If your car seems to be chugging along perfectly fine, why should you fork out the dough for service work? When this thought flows through your mind unabated, you could be setting yourself up for trouble in the future. Whether they are driven often or not, modern vehicles require regular maintenance to remain in optimal condition. If you neglect to complete timely maintenance, you could end up paying far more than you would have otherwise to fix whatever broke. To ensure you do not make this costly mistake, utilize this guide to better understand how regular car maintenance can prevent the need for extensive repairs.

When millennials entered the workforce at the turn of the present century, they faced an economy impacted by the Dot.com and mortgage industry bubble collapse, and both the automotive and mortgage industries were in crisis. For this highly educated workforce, the uncontrollable economic impact would threaten to leave Millennials employed at lower wage levels - and many without the corporate benefit of a retirement plan.

The 45th Annual SUN ‘n FUN International Fly-In and Expo will be held at the Lakeland Linder Airport in Lakeland, Florida from April 2 – 7 this year. I attended last year’s event and I had a blast. This is a huge event with plenty to see and do for at least 2 to 3 days. The great airshows alone are worth the price of admission. If you have just the slightest interest in aviation you don’t want to miss this show. It’s only a 3 hour drive from South Florida. But plan early as hotels in the area get filled up.

The favorable climate and geography of the Sunshine State make it almost uniquely suited to the staging of air displays, and its long show season typically runs from January to November.

The 2019 calendar features a wide range of events guaranteed to appeal to aviation and military history enthusiasts, aerobatics fans, vacationers and families looking for a great day out.

Buying your first home can be an exciting experience. Yet, with that excitement can come a laundry list of items to address to ensure your purchase goes off without a hitch. Give yourself the best chance for success by following the tips for first-time homebuyers listed below.

Help! I am buried in a pile of stuff! What can I toss and what should I keep?

In today’s consumer-driven world, we all tend to over accumulate. Decluttering is not only a popular buzz word but is actually a healthy habit. Getting rid of unnecessary material items helps one to function better in less crowded surroundings and very importantly, eases the psychological stress and anxiety that comes with owning and caring for too much stuff.

Americans move an average of 11 times in their lifetime. Packing up and moving out of your home is a big undertaking. Especially when you have accumulated years of “stuff”. Moving across town is tough. But moving across the country? Now that can be stressful. I moved from Texas to Florida last year and I learned a lot of definite “to-dos” and even more importantly, “what not to-dos”. If you’re planning on relocating to a different city or even state, here are some things to think about before making the big move.

As a massive group of individuals that recently transferred into adulthood and the largest generation currently in the labor force, millennials have a big impact on the financial landscape in many ways. As a generation, they stress a number of ideals that impact their relationship to finance, as well as their spending, saving, and investing habits.

When people are considering purchasing a motor vehicle, they often focus on the sticker price. Even though nobody likes to go over budget and pay more than they have to for a vehicle, it is important to consider the actual cost of owning a car. In some cases, people might be able to afford the car’s sticker price but not be able to afford the additional costs that come with it. With this in mind, how can people figure out the actual cost of owning a car? What are some of the factors to consider? We Florida Financial has done some of the research for you.

Sure, Let's Go!